Breaking News

Investing

The Lure of Profit in Art: Insights into Artprice100© Index's 2023 Triumphs

Lauren Miller

April 4, 2024 - 12:27 pm

The Art Market's Steadfast Ascendancy: A 2023 Performance Analysis

PARIS, April 4, 2024—Artprice, with its commitment to meticulous art market evaluation, has once again crafted a simulation to gauge the performance of investments in top-tier artists at global auction houses. In a recently conducted analysis of an artificial portfolio encompassing artworks by 100 of the world's highest-grossing artists, a positive note resounded—the portfolio witnessed growth with a total return on investment (ROI) of 1.55% for the calendar year 2023.

The year's yield, though modest in comparison to the robust 10% average annual growth since the millennium's start, is a testament to the enduring value ascent of blue-chip artists despite shifts in market dynamics. Last year lacked the presence of high-profile masterpieces—the likes of which graced 2022 through the sale of the celebrated Paul G. Allen Collection. In response, premier auction houses broadened their offerings. A more extensive volume of art, featuring pieces that are more recent, moderately priced, or those resurfacing to the auction scene at an accelerated rate, became available.

As noted in the comprehensive annual report for 2023 by Artprice, founders of Artmarket.com, there emerged a noticeable pivot from a sellers' market dominant in recent years to one that increasingly catered to buyers. Thierry Ehrmann, the CEO and Founder of Artmarket.com and Artprice, highlighted this strategic tilt. With buyers now commanding a strengthened stance, the exigency for quality has risen, even if it means the deceleration of high-end segment movement due to lesser availability of million-dollar-fetching artworks. Nonetheless, the blue-chip artist market experienced a slight uptick in valuation, affording investors modest gains.

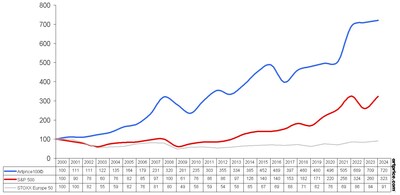

Artprice100© Versus Major Indices

The principle behind the calculation of Artprice100© takes a disciplined approach. Artprice updated its portfolio on January 1, 2023, continuing with the investment ideology from prior years. This practice involves theoretically holding stakes in the centenary cadre of top-selling artists on the secondary art market. Adjustments to the stakes are made annually, conditioned by the artists' auction turnover and the liquidity of their works in the previous five-year window. Thus, each artist’s weight in the portfolio corresponds proportionately to their turnover, modulated by a liquidity factor. This methodology underpins a structurally sound and balanced investment portfolio.

By December 31, 2023, Artprice observed the hypothetical appreciation in value of each artist by analyzing their respective price indices—excluding the results from the Print and Multiples sector—over the year. These indices get meticulously calculated by Artprice based on every fine art auction result of 2023. For instance, an investment in Gerhard Richter's works, which accounted for 2.8% of the Artprice100©, surged by a robust +21% by year's end. Conversely, Jean-Michel Basquiat's price index declined -15%, revealing the nuanced and complex behavior of the art market.

Despite some notable blue-chip artists such as Pablo Picasso, Andy Warhol, and Claude Monet experiencing downturns in pricing and together comprising a fifth of the portfolio, the extensive diversification within the Artprice100© resulted in positive territory closure, with the combined ROI for these 100 artists at +1.55%.

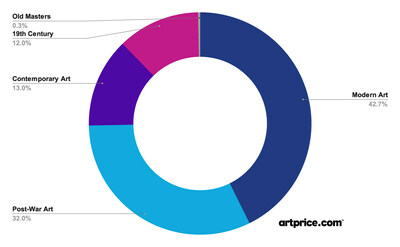

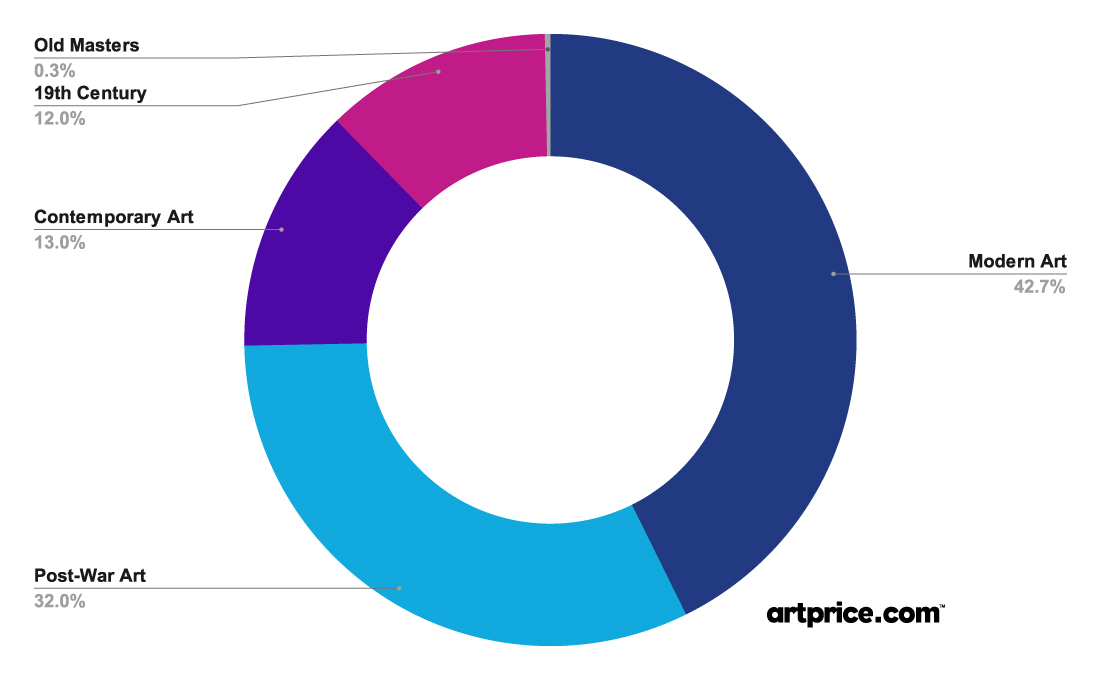

Evolving Dynamics of Artprice100©

The Artprice100©, while an insightful retrospective, also sheds light on emerging market trends. The once-prominent Old Masters now barely make a mark within the portfolio, with the exception of Chinese maestro Dong Qichang, who made the cut with a modest 0.3% investment. 19th century artists, however, impressed with an increased portfolio share, prompted particularly by stunning results from Vincent van Gogh and Paul Cézanne at the Paul G. Allen Collection sale. They, alongside their contemporaries, represented 12% of the initial 2023 investment—2% more than the previous year's start.

Period Influences on the Artprice100© Composition

Diving further into the portfolio's timeline, Modern Art persists as the dominant force, representing 43% of the outset 2023 investments. The Belgian Surrealist René Magritte and Chinese titan Qi Baishi are illustrative of the spectrum; while Magritte's values have soared by +38%, Qi Baishi saw a considerable -22% dip in the same period. This juxtaposition reflects the Art Market's inherent volatility.

Post-War Art, evident in its vitality, claimed five of the top 10 positions in the Artprice100© Index for 2023. A standout is Yayoi Kusama, whose artworks not only surged in popularity but also maintained a cumulative sales figure of $193 million from 812 auction lot sales, placing her as the 8th highest in the global art trade and soaring as the leading demanded female artist. On the contemporary spectrum, the young Adrian Ghenie represented the fresh faces with backed support from esteemed galleries such as Plan-B and Pace.

Primary Figures and Influences: A Closer Look

Pablo Picasso secured an 8.3% heavy-lift at the portfolio’s pinnacle, followed closely by Post-War giant Andy Warhol with a 5.1% stake. Monet graced the third spot within the 19th century genre at 5.0%. Contemporary prodigy Jean-Michel Basquiat and Zao Wou-Ki, representative of the Post-War Art segment, also ranked prominently. The diversity within this composition telegraphs the broad strokes of ingenuity and creative periods spanning from the grand masters to the contemporary innovators.

This finely woven artistic tapestry underscores the Art Market's immutable resilience and gravity, withstanding broader economic undulations and offering a bastion for calculated investment. It's a fabric ritually renewed, each year more vibrant and undeterred by the gyrations of global finance.

Investing in Art: Guidance and Future Outlook

The comprehensive report and numerical coverage provided by Artmarket.com aim to decipher and analyze the statistical realities within the art market. These insights should be seen as cerebral tools for understanding market behavior, not as direct investment advice or a beckoning to allocate resources within the sector.

Copyright Notices and Company Information

All content and statistical studies produced by Artmarket.com and Artprice are copyrighted and owned by thierry Ehrmann. Further information on these entities is easily accessible through their respective websites: www.artprice.com and www.artmarket.com. Artmarket.com, alongside its Artprice department, stands as a monumental pillar within the Art Market, equipped with over 30 million auction results.

Visions for a NFT-Centric Art Market Future

Artprice by Artmarket houses a lofty vision: to commandeer the Fine Art NFT platform stronghold globally. Through Artprice Images®, users are afforded unlimited access to a colossal digital art repository—a pictorial history spanning three centuries.

Artmarket.com is not only a treasure trove of invaluable art market data but also a patron of innovation, recognized by the Public Investment Bank for its trailblazing vigor. It carves out the future of the Art Market, equipped with inimitable Artificial Intelligence intuitiveness and sees no boundaries across the horizon of infinite artistic imagination and archival exploration.

Navigating The Galaxy of Artmarket and its Artprice Department

Immerse yourself in the revelatory world of Artmarket and its Artprice department with rich audiovisual content available at www.artprice.com/video. Here, the threads of imagination and technocracy blend seamlessly within the sprawling campus of the Organe Contemporary Art Museum, also hailed as "The Abode of Chaos". An exciting, full-span bilingual work can be explored here.

A Conduit for Art Market Intel

Artmarket with its Artprice department fine-tunes the pulse of the art market, providing essential intelligence to major press outlets and agencies. On social media, a robust community of over 7.2 million members and followers engage actively in the conversation that shapes and molds the trade of art globally.

Annual Reports: Windows into the Art Market's Soul

Annual art market reports by Artprice by Artmarket offer an unparalleled view of current trends and indicators. Interested readers can find them at The Art Market in 2023 and glean insights from the specific report focused on the contemporary art market at The Contemporary Art Market Report 2023.

Further Contact and Visual Evidences

For further exploration or contact, Thierry Ehrmann can be reached at [email protected] Visual references including Artprice statistics, portfolio compositions, and logos can be found through the provided URLs linked to PR Newswire media assets.

Through rigorous analysis and constant reinvention, the art market continues to flourish—even under the latent threats of economic vacillation. Investing in art, especially within the elite circle of blue-chip artists, paints not just a picture of aesthetic value but one of fiscal fortitude and long-term yield stability.

In conclusion, the Artprice100© Index of 2023 speaks volumes about the unwavering allure and profit potential inherent in the art market. A narrative of robust gains and subtle recalibrations, the index stands as a ledger of the market's relentless pursuit of value.

reit inquirer© 2024 All Rights Reserved